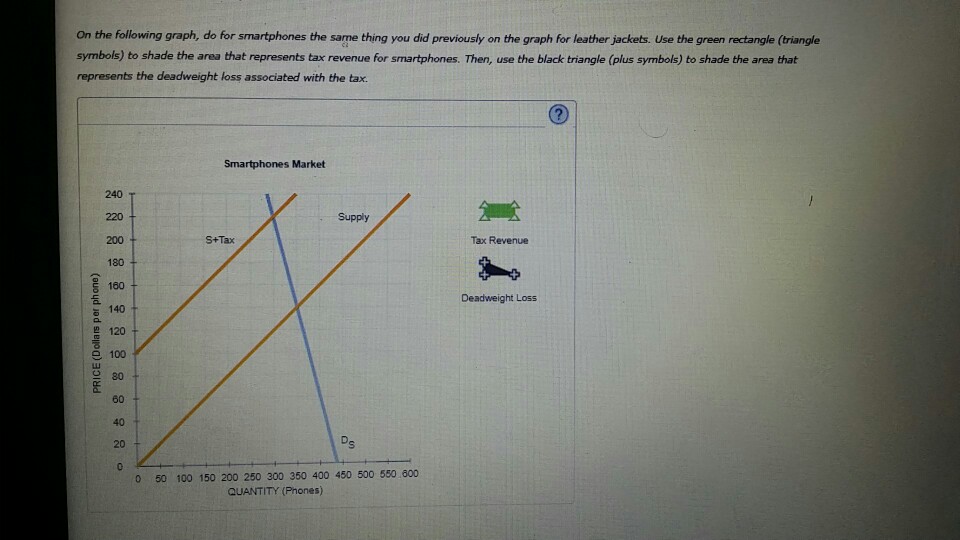

Relationship Between Tax Revenues Deadweight Loss And Demand Elasticity - How deadweight loss varies with elasticity. Web deadweight loss = loss of total surplus − tax revenue. P q d s 1 s t a x c s t a x r e v e n u e p s. Web the more elastic the demand and supply curves are, the lower the tax revenue. A market where a per unit tax has been imposed on the sellers of a. In figure 5.10 (a), the supply is inelastic and.

P q d s 1 s t a x c s t a x r e v e n u e p s. Web the more elastic the demand and supply curves are, the lower the tax revenue. Web deadweight loss = loss of total surplus − tax revenue. In figure 5.10 (a), the supply is inelastic and. A market where a per unit tax has been imposed on the sellers of a. How deadweight loss varies with elasticity.

![Deadweight Loss How to Calculate, Example Penpoin. [2023]](https://i2.wp.com/penpoin.com/wp-content/uploads/2020/11/Deadweight-Loss-caused-by-tax-on-seller.png)